| CATEGORII DOCUMENTE |

| Bulgara | Ceha slovaca | Croata | Engleza | Estona | Finlandeza | Franceza |

| Germana | Italiana | Letona | Lituaniana | Maghiara | Olandeza | Poloneza |

| Sarba | Slovena | Spaniola | Suedeza | Turca | Ucraineana |

Academy of Economic Studies

DAFI

Dissertation Paper

- briefing-

'The analysis of the software systems used in the mortgage loan '

Introduction

This purpose of this paper is to analyze the Romanian mortgage credit market and the software existent on this market, emphasizing the causal relationships between the mortgage market and the main factors that influence it: the cultural, political, social, legal environment, etc.

The history of mortgage loan.

The credit term has its origins in the

Latin words creditum which means trust

worthy. The mortgage first appeared in

In

In order to control the credits there are two institutions which are designed to monitor the market and centralize the client data:

The Credit Information Bureau (CIB) is a system specializing in the collection, storage and centralization of information on the exposure of all reporting entities (credit institutions or mortgage loan companies) in Romania to the debtors that were granted loans and/or incurred commitments whose cumulated value is higher than the reporting threshold (RON 20,000), as well as information on card frauds perpetrated by cardholders

The Romanian Credit Bureau was established in February 2004 by the banking system, as a needed support instrument for the retail activity powerful growth. The Bureau is a private company, with 27 banks owing capital stakes according to their retail market share. The main operational principle, provided in the Bureaus Statute, is the reciprocity principle, which states that institutions, from the banking and financial area, must provide data to the Credit Bureau in order to have access to those data. The system is going to be developed in 3 phases:

- Phase I negative information (on debtors with over 30 days past due payments, on fraudulent and on individuals providing false statements) received only from banking sources;

- Phase II negative and positive information (outstanding credits) collected from banking and non-banking institutions (consumer credit companies, insurance companies, leasing companies, telcos);

- Phase III implementation of value added products, including the credit scoring.

The bureau is now implementing the phase III of the program which is meant to be functional by the end of the year 2008

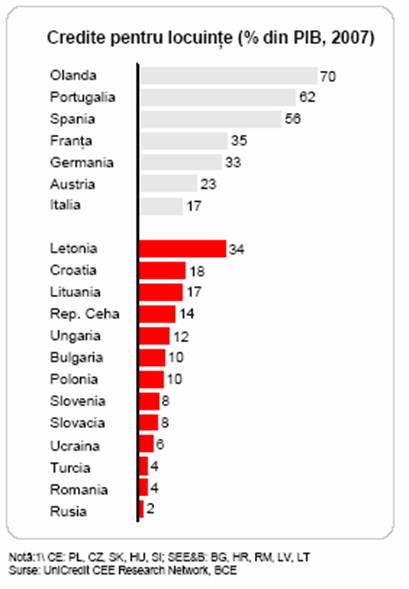

Mortgage loan market in Romania

The

mortgage loan market in

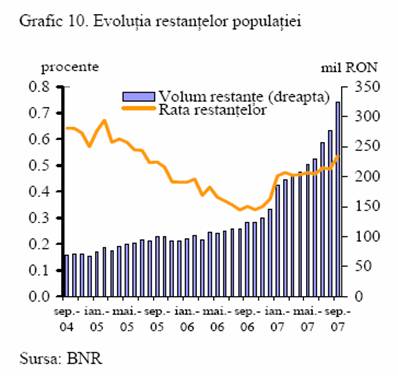

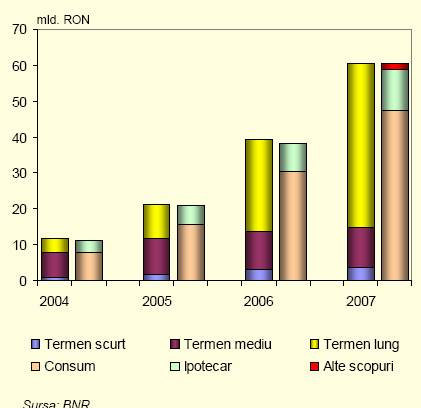

Since 2002 the volume of retail credit increased

continually, the main reason of this increase being the consumption loan. The

consumption loan represents three quarters of the loans given to the population

in

The competition in the credit market forced banks to set new market targets, situation which lead to relaxation of the loan conditions and to an optimistic perception of the risk.

Even if the data presented by the National Bank are optimistic, one must consider the fact that the real level of the risk can sub under evaluated due to the increase of the credit maturity period. According to the international experience, the less performant credits where given in the expansion faze of the economy, but la low quality of this appeared only when the expansion period decreased

Case study

I have made an analysis of the influence of the medium annual revenue and credit volume to the rate of overdue credit

|

Year |

Rate or credit overdue |

Credits given to the population (mld RON) (x1) |

Medium annual revenue (RON) (x2) |

Y-M(Y) |

(Y-M(Y))2 |

|

MEDIA |

| ||||

|

MIN | |||||

|

MAX | |||||

|

Media | |||||

|

Sy2 | |||||

|

Sy |

From the analysis of this indicators we can say that the medium value of the rate of credit overdue is 0.4343, with a deviation form the mean of 0.1474% and a variation coefficient of 33.95%, which is lower that 35% the mean being representatively

|

SUMMARY OUTPUT | |||||

|

Regression Statistics | |||||

|

Multiple R | |||||

|

R Square | |||||

|

Adjusted R Square | |||||

|

Standard Error | |||||

|

Observations | |||||

Multiple R is 0.8928 meaning that the connection between the variables is direct and quite powerful.

After this I have made a forecast of the rate if the volume of credit will increase by 1 mld RON. By estimating the value I reached to the conclusion that the value will be between (0.9%, 1.27%) with a probability of 95%.

Even though the model considered only two factors influencing the rate of credit overdue, there are also other factors which influence the rate: inflation rate, the interest rate, etc.

Credit scoring

Credit scoring is a scientific method which uses statistic models in order to evaluate the credibility of the person being analyzed. Credit scoring was first user in the 50s, but wined the popularity in the last two decades. There are different methods determining a persons score:

judgment scoring model

clustering algorithm

artificial intelligence

Nearest Neighbour

Neural networks

Decisions trees

FICO scores

Mortgage loan software

The politics concerning the adaptation of the informatics systems at the new requirements imposed by Basel II

For the banking systems to implement the requirements imposed by Basel II they need a rethinking of the software infrastructure of the banking system. Now only half of the credit institution in Romania have a set of politics, procedures and control processes for risk diminutions, while a quarter of the total credit institutions have tested and analyses their results of the informatics systems.

Basel II has a huge impact on the information administrated by each credit institution. To answer the new requirements, each banking institution must assure the following conditions:

the existence of a centralized database

the

database must be structured according to

o exposure classes

o risk degrees

o eligible guarantees

the existence of an informatics application for automating reporting in the new forms

A very important thing is also the communication with the main institutions which administrate the data concerning the creditors: Credit Information Bureau, and Credit Bureau

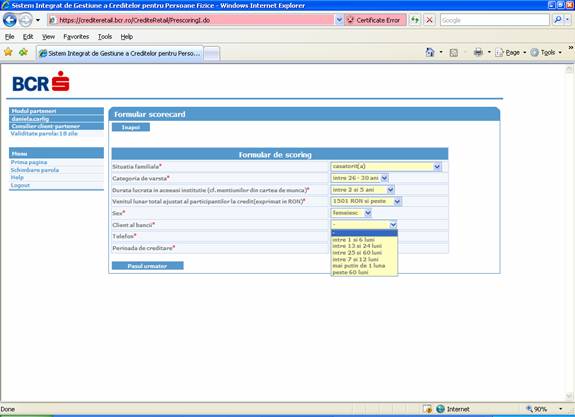

SIBCOR - BCR

ING Record

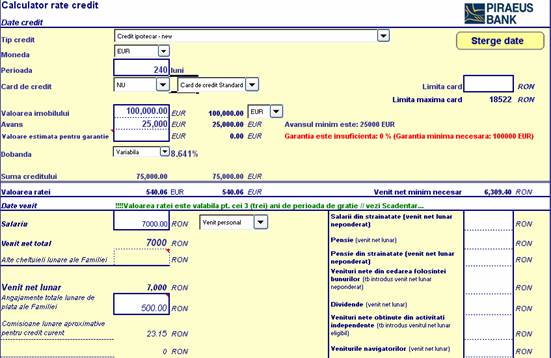

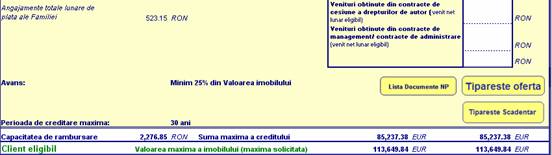

Pireus Bank

Conclusion

ING and BCR are two credit institutions which are made in house, answering each need, determining the credit score automatically, interacting with the credit bureau in real time, but as shown there are still credit institutions that are not applying any kind of credit scoring (Pireus), not having an informatic integrated system and still making credit application in excel.

On long term is very likely that the need of financing for real estate will increase and with that the need for mortgage loan. It is very important for the information concerning the credit behavior to be centralized.

|

Politica de confidentialitate | Termeni si conditii de utilizare |

Vizualizari: 1606

Importanta: ![]()

Termeni si conditii de utilizare | Contact

© SCRIGROUP 2024 . All rights reserved