| CATEGORII DOCUMENTE |

| Bulgara | Ceha slovaca | Croata | Engleza | Estona | Finlandeza | Franceza |

| Germana | Italiana | Letona | Lituaniana | Maghiara | Olandeza | Poloneza |

| Sarba | Slovena | Spaniola | Suedeza | Turca | Ucraineana |

Forms of Business Ownership and Business Combinations

Owning a Business

The Three Most Common Forms:

Sole Proprietorship

Partnership

Corporation

The three most common forms of business ownership are sole proprietorship, partnership, and corporation. Each form has its own characteristic internal structure, legal status, size, and fields to which it is best suited. Each has key advantages and disadvantages for the owners.

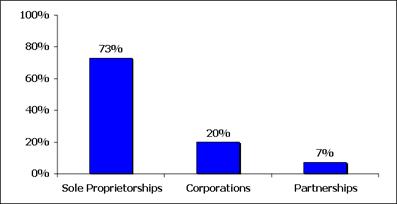

Popularity of Business Ownership Forms

The most popular form of business ownership is the proprietorship, followed by corporations, then partnerships.

Sole Proprietorship

A sole proprietorship is a business owned by one person (although it may have many employees), and it is the easiest and least expensive form of business to start. Many farms, retail establishments, and small service businesses are sole proprietorships, as are many home-based businesses (such as caterers, consultants, and computer programmers).

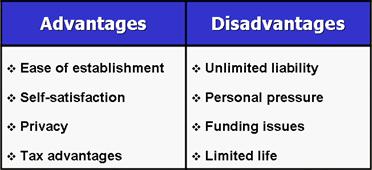

A sole proprietorship has many advantages. One is ease of establishment. All you have to do to launch a sole proprietorship is obtain necessary licenses, start a checking account for the business, and open your doors. Another advantage is the satisfaction of working for yourself. As a sole proprietor, you also have the advantage of privacy; you do not have to reveal your performance or plans to anyone. Although you may need to provide financial information to a banker if you need a loan, and you must provide certain financial information when you file tax returns, you do not have to prepare any reports for outsiders as you would if the company were a public corporation.

One major drawback of a sole proprietorship is the proprietors unlimited liability. From a legal standpoint, the owner and the business are one and the same. In some cases, the sole proprietors independence can also be a drawback because it means that the business depends on the talents and managerial skills of one person. Other disadvantages include the difficulty of a single-person operation obtaining large sums of capital and the limited life of a sole proprietorship.

Business Partnerships

If starting a business on your own seems a little intimidating, you might decide to share the risks and rewards of going into business with a partner. In that case, you would form a partnershipa legal association of two or more people as co-owners of a business for profit.

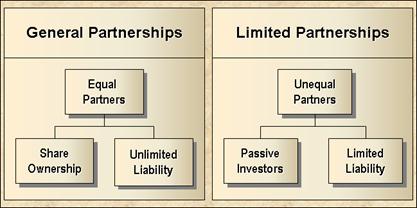

Partnerships are of two basic types. In a general partnership, all partners are considered equal by law, and all are liable for the businesss debts. To guard against personal liability exposure, some organizations choose to form a limited partnership. Under this type of partnership one or more persons act as general partners who run the business, while the remaining partners are passive investors (that is, they are not involved in managing the business). These partners are called limited partners because their liability (the amount of money they can lose) is limited to the amount of their capital contribution.

Advantages of Partnerships

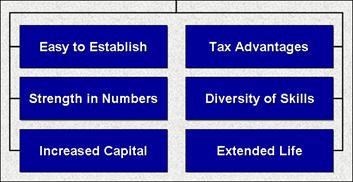

Proprietorships and partnerships have some of the same advantages. Like proprietorships, partnerships are easy to form. Partnerships also provide the same tax advantages as proprietorships, because profits are taxed at individual income-tax rates rather than at corporate rates.

However, in a couple of respects, partnerships are superior to sole proprietorships, largely because theres strength in numbers. When you have several people putting up their money, you can start a more ambitious enterprise. In addition, the diversity of skills that good partners bring to an organization leads to innovation in products, services, and processes, which improves your chances of success.

The partnership form of ownership also broadens the pool of capital available to the business. Not only do the partners personal assets support a larger borrowing capacity, but the ability to obtain financing increases because general partners are legally responsible for paying off the debts of the group. Finally, by forming a partnership you increase the chances that the organization will endure, because new partners can be drawn into the business to replace those who die or retire.

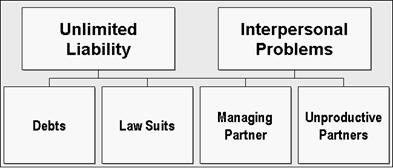

Disadvantages of Partnerships

Except in limited liability partnerships, at least one member of every partnership must be a general partner. All general partners have unlimited liability. Thus, if one of the firms partners makes a serious business or professional mistake and is sued by a disgruntled client, all general partners are financially accountable. At the same time, general partners are responsible for any debts incurred by the partnership

Another disadvantage of partnerships is the potential for interpersonal problems. Difficulties often arise because each partner wants to be responsible for managing the organization. Electing a managing partner to lead the organization may diminish the conflicts, but disagreements are still likely to arise. Moreover, the partnership may have to face the question of what to do with unproductive partners.

Partnership Agreement

Division of Profits

Dispute Resolution

Decision-Making Authority

Expected Contributions

A partnership agreement is a written document that states all the terms of operating the partnership by spelling out the partners rights and responsibilities. Although the law does not require a written partnership agreement, it is wise to work with a lawyer to develop one. One of the most important features of such an agreement is to address sources of conflict that could result in battles between partners. The agreement spells out such details as the division of profits, decision-making authority, expected contributions, and dispute resolution. Moreover, a key element of this document is the buy/sell agreement, which defines the steps a partner must take to sell his or her partnership interest or what will happen if one of the partners dies.

Corporations

Enter Into Contracts

Own and Sell Property

Sue and Be Sued

Enjoy Limited Liability

A corporation is a legal entity with the power to own property and conduct business. A corporation can receive, own, and transfer property; make contracts; sue; and be sued. Unlike the case with sole proprietorships and partnerships, a corporations legal status and obligations exist independently of its owners.

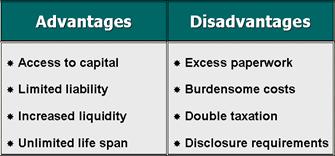

No other form of business ownership can match the success of the corporation in bringing together money, resources, and talent; in accumulating assets; and in creating wealth. The corporation has certain inherent qualities that make it the best vehicle for reaching those objectives. One such quality is limited liability. Although a corporate entity can assume tremendous liabilities, it is the corporation that is liable and not the private shareholders. In addition to limited liability, corporations that sell stock to the general public have the advantage of liquidity, which means that investors can easily convert their stock into cash by selling it on the open market. Thus, corporations tend to be in a better position than proprietorships and partnerships to make long-term plans, with their unlimited life span and funding available through the sale of stock.

Corporations are not without some disadvantages. The paperwork and costs associated with incorporation can be burdensome, particularly if you plan to sell stock. In addition, corporations are taxed twice. They must pay federal and state corporate income tax on the companys profits, and individual shareholders must pay income taxes on their share of the companys profits received as dividends. Another drawback pertains to publicly owned corporations. As mentioned earlier, such corporations are required by the government to publish information about their finances and operations.

Types of Corporations

Subchapter S

Limited Liability

Subsidiary

Certain types of corporations enjoy special privileges provided they adhere to strict guidelines and rules. One special type of corporation is known as the S corporation (or subchapter S corporation). An S corporation distinction is made only for federal income tax purposes; otherwise, in terms of legal characteristics, it is no different from any other corporation. Basically, the owners receive the tax advantages of a partnership while they raise money through the sale of stock. In addition, income and tax deductions from the business flow directly to the owners, who are taxed at individual income-tax rates, just as they are in a partnership.

Limited liability companies (LLCs) are another special type of corporation. These flexible business entities combine the tax advantages of a partnership with the personal liability protection of a corporation. Furthermore, LLCs are not restricted in the number of shareholders they can have, and members participation in management is not restricted as it is in limited partnerships.

Some corporations are not independent entities; that is, they are owned by a single entity. Subsidiary corporations, for instance, are partially or wholly owned by another corporation known as a parent company, which supervises the operations of the subsidiary. A holding company is a special type of parent company that owns other companies for investment reasons and usually exercises little operating control over those subsidiaries.

Alien

Foreign

Domestic

Corporations can

also be classified according to where they do business. An alien corporation

operates in the

Corporate Governance

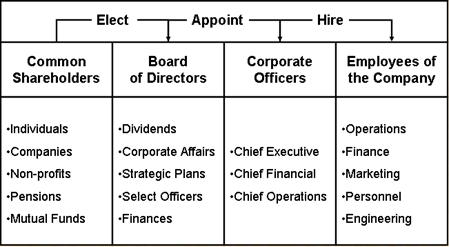

Shareholders of a corporation can be individuals, other companies, nonprofit organizations, pension funds, and mutual funds. All shareholders who own voting shares are invited to an annual meeting to choose directors, select an independent accountant to audit the companys financial statements, and attend to other business.

Representing the shareholders, the board of directors is responsible for declaring dividends, guiding corporate affairs, reviewing long-term strategic plans, selecting corporate officers, and overseeing financial performance.

The center of power in a corporation often lies with the chief executive officer, or CEO. Together with the chief financial officer (CFO) and the chief operating officer (COO), the CEO is responsible for establishing company policies, managing corporate direction, and making the big decisions that will affect the companys growth and competitive position.

Employees occupy positions is various departments: for example, operations, finance, marketing, personnel, and engineering.

The Rights of Shareholders

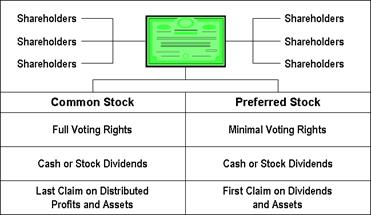

The corporation is owned by its shareholders, who are issued shares of stock in return for their investments. These shares are represented by a stock certificate, and they may be bequeathed or sold to someone else.

Most stock issued by corporations is common stock. Owners of common stock have voting rights and get one vote for each share of stock they own. Besides conferring voting privileges, common stock frequently pays dividends, payments to shareholders from the companys profits. In addition to dividends, common shareholders can earn a return on their investment.

In contrast to common stock, preferred stock does not usually carry voting rights. It does, however, give preferred shareholders the right of first claim on the corporations assets (in the form of dividends) after all the companys debts have been paid. This right is especially important if the company ever goes out of business. Moreover, preferred shareholders get their dividends before common shareholders do.

The Power of Shareholders

The stock of a private corporation such as Kinkos is held by only a few individuals or companies and is not publicly traded. By withholding their stock from public sale, the owners retain complete control over their operations and ownership. Private corporations finance their operating costs and growth from either company earnings or other sources, such as bank loans. By contrast, the stock of a public corporation is held by and available for sale to the general public; thus the company is said to be publicly traded.

Public Stock Ownership: Advantages

Increased Liquidity

Enhanced Visibility

Open Market Value

Flexibility

Bear in mind that in addition to providing a ready supply of capital, public ownership has other advantages and disadvantages. Among the advantages are increased liquidity, enhanced visibility, and the establishment of an independent market value for the company. Moreover, having a publicly traded stock gives companies flexibility to use such stock to acquire other firms. This was one of the primary reasons UPS decided to sell 10 percent of its stock to the public in 1999, after nearly a century of remaining a privately held organization.

Public Stock Ownership: Disadvantages

Cost of Going Public

SEC Requirements

Public Exposure

Loss of Control

Nevertheless, selling stock to the public has distinct disadvantages: (1) the cost of going public is high (ranging from $50,000 to $500,000), (2) the filing requirements with the SEC (Securities and Exchange Commission) are burdensome, (3) ownership control is lost, (4) management must be ready to handle the administrative and legal demands of heightened public exposure, and (5) the value of the companys stock becomes subject to external forces beyond the companys control.

Responsibilities of the Board of Directors

Declaring dividends

Guiding corporate affairs

Reviewing long-term plans

Selecting corporate officers

Overseeing financial performance

Representing the shareholders, the board of directors is responsible for declaring dividends, guiding corporate affairs, reviewing long-term strategic plans, selecting corporate officers, and overseeing financial performance.

The Topic of Board Reform

Compensation

Duties

Integrity

The success of any meeting depends largely on the effectiveness of its leader.

The leader is responsible for staying focused: that is, keeping the meeting moving along, pacing the presentation and discussion, and summarizing meeting achievements.

One way a leader can improve the productivity of a meeting is by using parliamentary procedure, a time-tested method for planning and running effective meetings. The basic principles of parliamentary procedure can help teams to transact business efficiently, protect individual rights, maintain order, preserve a spirit of harmony, and accomplish team and organizational goals.

Some participants are too quiet and others are too talkative. The best meetings are those in which everyone participates, so a leader must not let one or two people dominate the meeting while others doodle on their notepads.

At the end of the meeting, the leader should summarize the discussion or list the actions to be taken and specify who will take them and when. Wrapping things up ensures that all participants agree on the outcome and gives people a chance to clear up any misunderstandings.

As soon as possible after the meeting, the leader must make sure that all participants receive a copy of the minutes or notes, showing recommended actions, schedules, and responsibilities.

Business Combinations

Mergers

Consolidations

Leveraged Buyouts

Acquisitions

Two of the most popular forms of business combinations are mergers and consolidations. The difference between a merger and a consolidation is fairly technical, having to do with how the financial and legal transaction is structured. Basically, in a merger, one company buys another company, or parts of another company, and emerges as the controlling corporation. The controlling company assumes all the debts and contractual obligations of the company it acquires, which then ceases to exist. A consolidation is similar to a merger except that an entirely new firm is created by two or more companies that pool their interests. In a consolidation, both firms terminate their previous legal existence and become part of the new firm.

A third way that a company can acquire another firm is by purchasing that firms voting stock. This transaction is generally referred to as an acquisition and is completed when the shareholders of the acquired firm tender their stock for either cash or shares of stock in the acquiring company. A leveraged buyout (LBO) occurs when one or more individuals purchase a companys publicly traded stock by using borrowed funds. The debt is expected to be repaid with funds generated by the companys operations and, often, by the sale of some of its assets.

Mergers, Consolidations, and Acquisitions

Business combinations provide several financial and operational advantages. Combined entities hope to eliminate expenditures for redundant resources; increase their buying power as a result of their larger size; increase revenue by cross-selling products to each others customers; increase market share by combining product lines to provide more comprehensive offerings; eliminate manufacturing overcapacity; and gain access to new expertise, systems, and teams of employees who already know how to work together. Often these advantages are grouped under umbrella terms such as economies of scale, efficiencies, or synergies, which generally mean that the benefits of working together will be greater than if each company continued to operate independently.

Despite the promise of economies of scale, studies of merged companies show that 65 to 85 percent of these deals fail to actually achieve promised efficiencies. Part of the problem with mergers is that companies often borrow immense amounts of money to acquire a firm, and the loan payments on this corporate debt gobble up cash needed to run the business. Moreover, managers must help combine the operations of the two entities, pulling them away from their normal day-to-day responsibilities. Another obstacle that companies face when combining forces is that they tend to underestimate the difficulties of merging two cultures.

Current Corporate Trends

After a decade of

unprecedented megamergers, some of the largest

Hostile Takeovers

Tender Offer

Proxy Fight

Although 95 percent of all business combinations are friendly deals, some 5 percent are hostile takeovers, in which one party fights to gain control of a company against the wishes of the existing management.

As mentioned earlier, every corporation that sells stock to the general public is potentially vulnerable to takeover by any individual or company that buys enough shares to gain a controlling interest. Basically, a hostile takeover can be launched in one of two ways: by tender offer or by proxy fight. In a tender offer, the raider offers to buy a certain number of shares of stock in the corporation at a specific price. The price offered is generally more than the current stock price so that shareholders are motivated to sell. The raider hopes to get enough shares to take control of the corporation and to replace the existing board of directors and management. In a proxy fight, the raider launches a public relations battle for shareholder votes, hoping to enlist enough votes to oust the board and management.

Defenses Against Hostile Takeovers

Corporate boards and executives have devised a number of schemes to defend themselves against unwanted takeovers:

The poison pill. This plan, triggered by a takeover attempt, makes the company less valuable in some way to the potential raider; the idea is to discourage the takeover from actually happening.

The golden parachute. This method is designed to benefit a companys top executives by guaranteeing them generous compensation packages if they ever leave or are forced out after a takeover.

The shark repellent. This tactic is more direct; it is simply a requirement that stockholders representing a large majority of shares approve of any takeover attempt. Of course, such a plan is viable only if the management team has the support of the majority of shareholders.

The white knight. This tactic uses a friendly buyer to take over the company before a raider can. White knights usually agree to leave the current management team in place and to let the company continue to operate in an independent fashion.

Alternative Business Forms

A strategic alliance is a long-term partnership between companies to jointly develop, produce, or sell products. A joint venture is a special type of strategic alliance in which two or more firms jointly create a new business entity that is legally separate and distinct from its parents.

Strategic alliances can accomplish many of the same goals as a merger, consolidation, or acquisition without requiring a painstaking process of integration. They can help a company gain credibility in a new field, expand its market presence, gain access to technology, diversify offerings, and share best practices without forcing the partners to become fast friends for life. If the arrangement does not work out or its usefulness expires, the partners can simply go their separate ways.

Companies can also form joint ventures to accomplish the same benefits enjoyed by strategic alliances. Joint ventures are similar to partnerships except that they are formed for a specific, limited purpose. Like strategic alliances, joint ventures have many advantages. They allow companies to use each others complementary strengths that might otherwise take too long to develop on their own, and they allow companies to share what may be the substantial cost and risk of starting a new operation.

KEY TERMS

acquisition - Form of business combination in which one company buys another company's voting stock

boord of directors - Group of people, elected by the shareholders, who have the ultimate authority in guiding the affairs of a corporation

chief executive officer (CEO) - Person appointed by a corporation's board of directors to carry out the board's policies and supervise the activities of the corporation

common stock - Shares whose owners have voting rights and have the last claim on distributed profits and assets

consolidation - Combination of two or more companies in which the old companies cease to exist and a new enterprise is created

corporation - Legally chartered enterprise having most of the legal rights of a person, including the right to conduct business, to own and sell property, to borrow money, and to sue or be sued; owners of the corporation enjoy limited liability

dividends - Distributions of corporate assets to shareholders in the form of cash or other assets

general partnership - Partnership in which all partners have the right to participate as co-owners and are individually liable for the business's debts

holding company - Company that owns most, if not all, of another company's stock but that does not actively participate in the management of that other company

hostile takeovers - Situations in which an outside party buys enough stock in a corporation to take control against the wishes of the board of directors and corporate officers

leveraged buyout (LBO) - Situation in which individuals or groups of investors purchase a company primarily with debt secured by the company's assets

limited liability companies (LLCs) - Organizations that combine the benefits of S corporations and limited partnerships without the drawbacks of either

limited partnership - Partnership composed of one or more general partners and one or more partners whose liability is usually limited to the amount of their capital investment

merger - Combination of two companies in which one company purchases the other and assumes control of its property and liabilities

parent company - Company that owns most, if not all, of another company's stock and that takes an active part in managing that other company

partnership - Unincorporated business owned and operated by two or more persons under a voluntary legal association

preferred stock - Shares that give their owners first claim on a company's dividends and assets after paying all debts

privote corporation - Company owned by private individuals or companies

proxy - Document authorizing another person to vote on behalf of a shareholder in a corporation

public corporation - Corporation that actively sells stock on the open market

S corporation - Corporations with no more than 75 shareholders that may be taxed as a partnership; also known as a subchapter S corporation

shareholders - Owners of a corporation

sole proprietorship - Business owned by a single individual

subsidiary corporations - Corporations whose stock is owned entirely or almost entirely by another corporation

unlimited liability - Legal condition under which any damages or debts attributable to the business can also be attached to the owner because the two have no separate legal existence

|

Politica de confidentialitate | Termeni si conditii de utilizare |

Vizualizari: 4681

Importanta: ![]()

Termeni si conditii de utilizare | Contact

© SCRIGROUP 2025 . All rights reserved