Russia

|

Country

Overview

|

|

Chief

of State

|

Vladimir Vladimirovich Putin

(acting president since December 31, 1999, president since May 7, 2000);

re-elected March 2004

|

|

Head

of Government

|

Mikhail Fradkov (since March 2004)

|

|

Location

|

Northern Asia (that part west of

the Urals is included with Europe), bordering the Arctic Ocean, between

Europe and the North Pacific Ocean

|

|

Independence

|

24 August 1991 (from Soviet Union)

|

|

Population

(2006E)

|

|

|

Languages

|

Russian, many minority languages

|

|

Religion

|

Russian Orthodox, Muslim, other

|

|

Ethnic

Group(s)

|

Russian 79.8%, Tatar 3.8%,

Ukrainian 2%, Bashkir 1.2%, Chuvash 1.1%, other or unspecified 12.1% (2002

census)

|

|

|

|

Economic Overview

|

|

Net

Exports (2006)

|

$141 Billion

|

|

Current

Account Balance (2006)

|

$95.6 Billion

|

|

|

|

Energy Overview

|

|

Minister

of Energy

|

Viktor Borisovich Khristenko

|

|

Proven

Oil Reserves (January 1, 2007E)

|

60 billion barrels

|

|

Oil

Production (2006E)

|

9,674 thousand barrels per day, of

which 96% was crude oil

|

|

Oil

Consumption (2005E)

|

2,854 thousand barrels per day

|

|

Crude

Oil Distillation Capacity (2007E)

|

5,339 thousand barrels per day

|

|

Proven

Natural Gas Reserves (January 1, 2007E)

|

1,680 trillion cubic feet

|

|

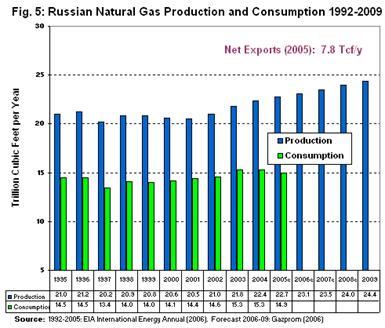

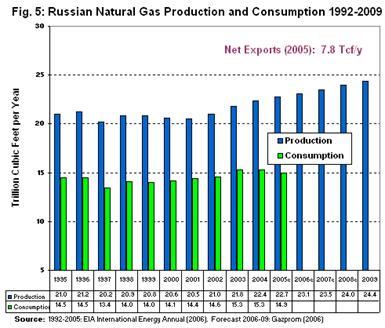

Natural

Gas Production (2004E), (2005E)

|

22.4 trillion cubic feet (tcf),

22.7 tcf

|

|

Natural

Gas Consumption (2004E), (2004E)

|

16.0 Trillion cubic feet (tcf)

|

|

Recoverable

Coal Reserves (2003E)

|

173,073.9 million short tons

|

|

Coal

Production (2004E)

|

308.9 million short tons

|

|

Coal

Consumption (2004E)

|

257.5 million short tons

|

|

Electricity

Installed Capacity (2004E)

|

215.3 gigawatts

|

|

Electricity

Production (2004E)

|

881.6 billion kilowatt hours

|

|

Electricity

Consumption (2004E)

|

804 billion kilowatt hours

|

|

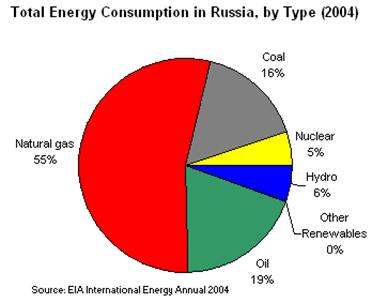

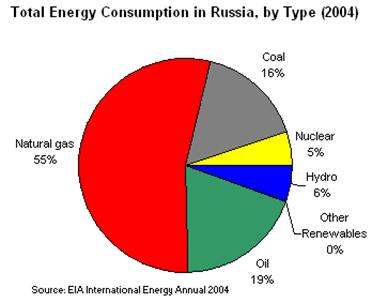

Total

Energy Consumption (2004E)

|

30.1 quadrillion

Btus*, of which Natural Gas (55%), Oil (19%), Coal (16%), Hydroelectricity

(6%), Nuclear (5%), Other Renewables (0%)

|

|

Total

Per Capita Energy Consumption (2004E)

|

208.8 million Btus

|

|

Energy

Intensity (2004E)

|

15,763 Btu per $2000-PPP**

|

|

|

|

Environmental Overview

|

|

Energy-Related

Carbon Dioxide Emissions (2004E)

|

1,684.8 million metric

tons, of which Natural Gas (52%), Coal (26%), Oil (22%)

|

|

Per-Capita,

Energy-Related Carbon Dioxide Emissions (2004E)

|

11.7 metric tons

|

|

Carbon

Dioxide Intensity (2004E)

|

0.9 Metric tons per thousand

$2000-PPP**

|

|

Environmental

Issues

|

air pollution from heavy industry,

emissions of coal-fired electric plants, and transportation in major cities;

industrial, municipal, and agricultural pollution of inland waterways and

seacoasts; deforestation; soil erosion; soil contamination from improper

application of agricultural chemicals; scattered areas of sometimes intense

radioactive contamination; groundwater contamination from toxic waste; urban

solid waste management; abandoned stocks of obsolete pesticides

|

|

Major

Environmental Agreements

|

party to: Air Pollution, Air

Pollution-Nitrogen Oxides, Air Pollution-Sulfur 85, Antarctic-Environmental

Protocol, Antarctic-Marine Living Resources, Antarctic Seals, Antarctic

Treaty, Biodiversity, Climate Change, Climate Change-Kyoto Protocol,

Endangered Species, Environmental Modification, Hazardous Wastes, Law of the

Sea, Marine Dumping, Ozone Layer Protection, Ship Pollution, Tropical Timber

83, Wetlands, Whaling signed, but not ratified: Air Pollution-Sulfur 94

|

|

|

|

Oil and Gas Industry

|

|

Organization

|

Transneft is predominant pipeline

operator. State has majority ownership of Gazprom and Rosneft.

|

|

Major

Oil/Gas Ports

|

Primorsk, Novorossiysk

|

|

|

Russia

Russia holds the world's largest natural gas reserves, the

second largest coal reserves, and the eighth largest oil reserves.

Russia is also the world's largest exporter of natural gas, the second largest

oil exporter and the third largest energy consumer.

In 2006, Russias real gross domestic

product (GDP) grew by approximately 6.7 percent, surpassing average growth rates

in all other G8 (the G8 stands for the

'Group of Eight' nations. It began in 1975 when President Giscard d'Estaing of France invited the leaders of Japan, the USA,

Germany, the United Kingdom and Italy

to Rambouillet, near Paris,

to discuss the economic problems of the day. The group expanded to include Canada in 1976 and Russia in 1998. Unlike many other

international bodies, the G8 does not have a fixed structure or a permanent

administration. It is up to the country that has the Presidency to set the agenda

and organize the annual G8 Summit)

countries, marking the countrys seventh consecutive year of economic

expansion. Russias

economic growth over the past seven years has been driven primarily by energy

exports, given the increase in Russian oil production and relatively high world

oil prices during the period. Internally, Russia gets over half of its

domestic energy needs from natural gas, up from around 49 percent in 1992.

Since then, the share of energy use from coal and nuclear has stayed constant,

while energy use from oil has decreased from 27 percent to around 19 percent.

Russias economy is heavily dependent on oil

and natural gas exports, making it vulnerable to fluctuations in world oil

prices. According to an International Monetary Fund (IMF) study, a $1 per

barrel increase in Urals blend oil prices for a year is estimated to raise

federal budget revenues by 0.35 percent of GDP, or $3.4 billion. In order to

manage windfall oil receipts, the government established a stabilization fund

in 2004 worth. By the end of 2006, the fund was expected to be worth almost $80

billion, or about 7 percent of the countrys nominal GDP. Raw materials, such

as oil, natural gas, and metals, dominate merchandise exports and account for

over two-thirds of all Russian export revenues.

Although estimates vary widely, the IMF and

World Bank suggest that in 2005 the oil and gas sector represented around 20

percent of the countrys GDP, generated more than 60 percent of its export

revenues (64% in 2007), and accounted for 30 percent of all foreign direct

investment (FDI) in the country.

Kremlin policy makers continue to exhibit

an inclination to advance the state's influence in the energy sector. Taxes on

oil exports and extraction are still high, and Russias state-influenced oil and

gas companies are obtaining controlling stakes in previously foreign-led

projects. State-owned export facilities have grown at breakneck pace, while

private projects have progressed more slowly or have been met with roadblocks

by state-owned companies or by various government agencies.

-Oil-

Russia

is a major world oil producer, sometimes producing even more than Saudi Arabia.

Following the collapse of the former Soviet Union (FSU), Russias oil

output fell sharply, and has rebounded only in the last several years.

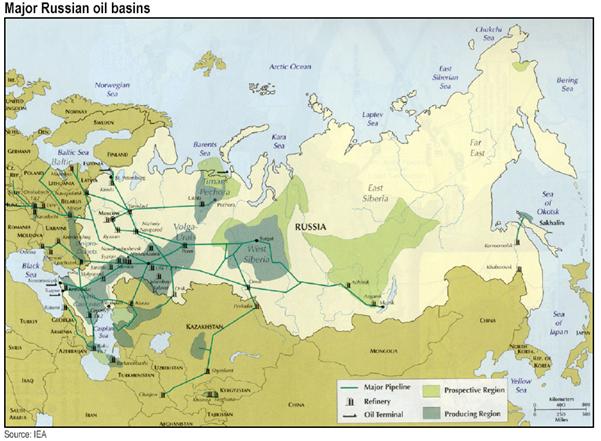

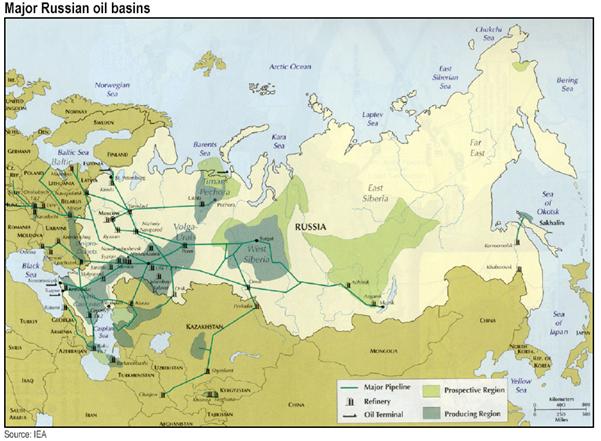

Reserves

According to the Oil and Gas Journal,

Russia has proven oil

reserves of 60 billion barrels, most of which are located in Western Siberia,

between the Ural Mountains and the Central

Siberian Plateau. Eastern Siberia is one area

where little exploration has taken place. There, only four or five oil and gas

fields have been discovered, and a 1996 Petroconsultants study (the latest

available) estimated that around 35 million barrels of oil and 5 Trillion Cubic

feet (tcf) of natural gas exist in the region.

Production

In the 1980s, the Western Siberia region,

also known as the Russian Core, made the Soviet Union

a major world oil producer, allowing for peak production of 12.5 million

barrels per day in total liquids in 1988. Following the collapse of the Soviet

Union in 1991, Russias

oil production fell precipitously, reaching a low of roughly 6 million bbl/d,

or around one-half of the Soviet-era peak (see Fig.

1). According to observers, several other factors are thought to have caused

the decline, including the depletion of the country's largest fields due to

state-mandated production surges and the lack of investment in field

maintenance.

A turnaround in Russian oil output began

in 1999. Many analysts attribute the rebound in production to the privatization

of the industry following the collapse of the Soviet Union.

The privatization clarified incentives and increased less expensive production.

Higher world oil prices (oil prices tripled between January 1999 and September

2000), the use of technology that was standard practice in the West, and the

rejuvenation of old oil fields also helped raise production levels. Other

experts partially attribute the increase to after-effects of the 1998 financial

crisis, the fall in oil prices, and the subsequent devaluation of the ruble.

In 2006 Russian total liquids production

averaged almost 9.7 million bbl/d, including 9.2 million

bbl/d of crude oil, a 220,000 bbl/d increase over 2005. This growth rate

was down from annual growth of roughly 700,000 bbl/d between

2002-2004.

In upcoming years, total Russian oil

production is expected to grow at an annual rate of around 1.5-2.5 percent

partially due to growth in output from the Sakhalin

projects. Government taxation of production and export revenues along with the

continued lack of clarity concerning the ownership of subsoil resources

contributed to lower output for 2006 and could possibly contribute to lower

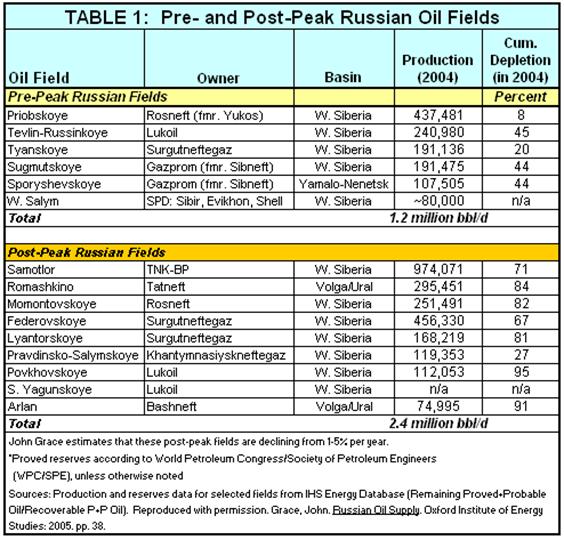

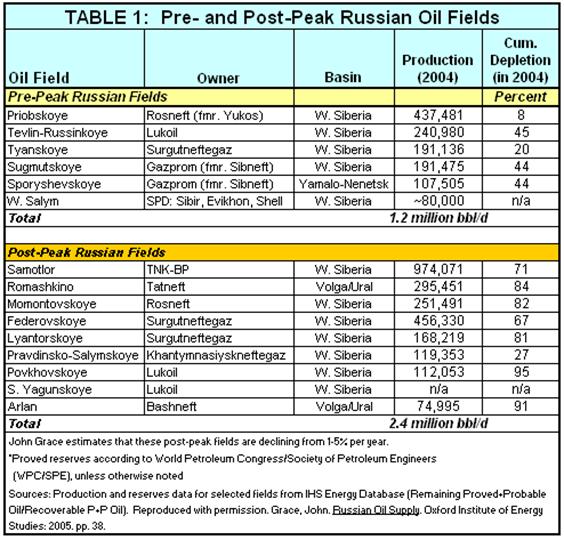

than expected output during 2007. As Table 1 (below) shows, production from

mature oil fields also has a major role in the recent slowdown in Russian oil

supply growth.

In the upcoming decade, a few major oil

fields (listed in Table 1 below) will contribute to most of Russias supply

growth and others will offset decreasing production from mature fields. In

2004, around 20 percent (or 1.8 million bbl/d) of Russias oil production came from

fields that had already produced 80 percent of their total recoverable

reserves. Achieving continued growth at post-peak fields will become more

problematic as oil companies run out of easy and less costly opportunities to

manage the rate of decline.

Pre-peak fields, which have come online

in the last decade, can add between around 1.2-1.5 million bbl/d to Russian

supply according to John Graces recent analysis of Russias oil supply. New

field developments will produce almost all of Russias annual oil growth in the

next five years and will likely produce more than half of the countrys oil in

2020.

Refinery Sector

Russia has 41 oil refineries with a total

crude oil processing capacity of 5.4 million bbl/d, but many of the refineries

are inefficient, aging, and in need of modernization. According to Energy

Intelligence, refinery throughput at Russian refineries increased by

roughly 5.8 percent to around 4.4 million bbl/d in

2006. Russian refineries produced around 1.1 million bbl/d of Mazut, 1.3

million bbl/d fuel oil, and 800,000 bbl/d gasoline.

Retail product prices are typically lower than world oil product prices,

hurting incentives to supply the local market. For example, in 2005 retail

gasoline and automotive diesel prices in Russia were approximately $2.05 and

$1.88 per gallon, respectively. In contrast, gasoline and diesel prices average

around $5.50 and $4.90 in OECD Europe.

Oil Exports

Russias production growth in the upcoming

decade will depend on the availability of viable export routes for the

countrys crude oil. Transneft currently has a monopoly over Russias

pipeline network.

Russia's Oil Balance

During 2006, Russia produced roughly

9.8 million bbl/d of liquids (not including oil products), consumed roughly 2.8

million bbl/d in liquids, and exported (in net) around 7 million bbl/d.

According to official Russian statistics, roughly 4 million of this total is

crude oil. Over 70 percent of Russian crude oil production is exported, while

the remaining 30 percent is refined locally. Crude oil exports via pipeline

fall under the exclusive jurisdiction of Russia's state-owned pipeline

monopoly, Transneft .

Expanding Russia's capacity to export oil in

order to keep pace with the country's growing production is important to both

Russian policymakers and oil companies. However, the two sides are sometimes at

odds over how best to boost the country's export capacity.

Destinations of Russian Oil Exports

During 2006, Russia exported almost 4 million

bbl/d of crude oil, and over 2 million bbl/d (102 million

tonnes) of oil products. Roughly 1.3 million bbl/d were exported via the

Druzhba pipeline to Belarus, Ukraine, Germany, Poland, and other destinations

in Central and Eastern Europe (including Hungary, Slovakia, and the Czech

Republic), around 1.3 million bbl/d via the new flagship Primorsk port near St.

Petersburg, and around 900,000 bbl/d via the Black Sea.

The majority of Russias oil

exports transit via Transneft-controlled pipelines, but around 300,000 bbl/d of

oil is transported via other non-Transneft-controlled sea routes or via rail.

Because of higher world oil prices recently, almost 170,000 bbl/d of Russia's oil is

transported via railroad (see Fig. 2 ).

Oil Product Exports and Balance

Most of Russia's

product exports consist of fuel oil and diesel fuel ,

which are used for heating in European countries and, on a small scale, in the United States. Russian

oil exports to the U.S have almost doubled since 2004, rising to almost 500,000 bbl/d of crude oil and products. Increases

in product exports can be attributed to political pressures to maintain

refinery operations and higher international oil product prices. A draft plan

for the refining sectors development for 2005-2008 foresees continued

increases in the production of high quality light oil products, catalysts and

raw material for the petrochemical industry. As production of fuel oil is reduced,

local refineries are only meeting about half of the countrys demand for high

octane gasoline. Consequently, Russia

must import the remainder.

Europe has been increasingly concerned

about the stability of oil (and gas) exports from Russia since early 2006. OECD

Europes reliance on Russian crude exports has grown from around 9 percent of

total crude imports in 1995 to around 29 percent in 2006. Using a different

barometer, the share of Europes oil consumption that comes from Russia has

grown from around 7.5 percent to around 25 percent during the same time period.

Proposed Oil Pipeline Routes and Pipeline

Expansion Projects

Baltic

Pipeline System (BPS) Expansion

The BPS came online in December 2001

carrying crude oil from Russia's

West Siberian and Timan-Pechora oil provinces westward to the newly completed port of Primorsk in the Russian Gulf of

Finland. The BPS gives Russia

a direct outlet to northern European markets, allowing the country to reduce

its dependence on transit routes through Estonia,

Latvia, and Lithuania.

Unfortunately for the Baltic countries, the growth of the BPS has come at

considerable cost, as Russian crude which traditionally moved through the

Baltic region has been re-routed through the BPS.

Throughput capacity at Primorsk has

steadily increased, reaching around 1.3 million bbl/d during

2006 on average, and 1.5 million bbl/d as recently as March 2007. In the

aftermath of the transit dispute with Belarus

in January 2007, Transneft president Semyon Vainshtok announced preliminary

plans to build a pipeline spur from the Belarus border to Primorsk at an

initial capacity of 1 million bbl/d, with the

possibility of further expansion to 1.5 million bbl/d. The construction,

although not sanctioned yet by the Russian government, could be completed in as

few as 18 months. The expansion, called BPS-II, would expand Primorsks export

capacity to around 3 million bbl/d.

Related information on energy in the

Baltic Sea Region is discussed in the Baltic Sea Region Country Analysis Brief .

Murmansk Area and Kharyaga-Indiga Pipeline

International shipping from the Murmansk area has two advantages: the port is ice-free

most of the year, and it is deep enough to make shipping to the United States economic without reloading in Europe. Several pipeline proposals connecting the Murmansk area to existing

producing areas in the south in the last several years have been met with

lukewarm reactions by Transneft. The state-owned company now plans a pipeline

to Indiga, 240 miles from the Timan-Pechora producing basin,

that is closer but iced over in winter. No timeline has been set for

construction. Oil from Timan-Pechora has a lesser sulfur content and is lighter

than the rest of the Urals blend.

Now, Russian oil is delivered to the Murmansk area by rail,

and last year around 270,000 bbl/d of oil and products were shipped from the

area. Sintez Corp and Arktikshelfneftegaz are planning a 200,000 bbl/d loading

facility with plans to expand to around 500,000 bbl/d

by 2025. Lukoil is building up its terminal at Varandei to include a tank farm

of 325,000 cubic meters, two underwater pipelines of 14 miles each and an

ice-resistant loading facility.

Druzhba Pipeline and Adria Reversal

Project

Of the 1.3 million bbl/d of oil

transported via the Druzhba Pipeline, only around 350,000 bbl/d flows to the

south to Hungary, the Czech Republic

and Slovakia.

Reversal of the Adria pipeline, which spans between Croatia's

port of Omisalj

on the Adriatic Sea and Hungary

(see map), has been under consideration since the 1990s. The pipeline, which

was completed in 1974, was originally designed to load Middle Eastern oil at

Omisalj, then pipe it northward to Yugoslavia and on to Hungary. However, given

both the Adria pipeline's existing interconnection with the Russian system, and

Russia's booming production,

the pipeline's operators and transit states have since considered reversing the

pipeline's flow, thus giving Russia

a new export outlet on the Adriatic Sea. The

proposal included expanding the pipelines capacity from

100,000 bbl/d to 300,000 bbl/d at a cost of around $320 million.

In 2005, Croatia determined that an

environmental impact study of such a reversal was incomplete and not based on

enough expert knowledge, thereby killing the proposal. During the Belarus-Russia

oil dispute in 2007, Hungary

said that it could technically reverse its portion of the pipeline within 20-30

days.

Eastern Siberia Pacific Ocean Pipeline

(ESPO): Taishet - Skovorodino - Kozmino

Bay

Until 2004, Russian energy officials were

unwilling to commit to one of two oil transit pipelines to eastern Asia. President Putin announced that Russia would commit to building a pipeline route

from the Russian city of Taishet to Kozmino Bay, southeast of Nakhodka. The endpoint

for the pipeline was moved from Perevoznaya

Bay to protect endangered

species there. More recently Putin and Transneft officials have clarified that

the 2,500-mile pipeline will be built in two stages.

The first stage of the pipeline will

include the construction of a 600,000 bbl/d pipeline from Taishet to

Skovorodino along with a port facility at Kozmino Bay.

Oil will be shipped via rail to the Pacific coast until the second stage of the

pipeline is constructed. China

has agreed to finance the 43-mile, 300,000-bbl/d spur from Skovorodino to the

Chinese border. Transneft now estimates that the first stage of the project

will cost around $11 billion, up from an original estimate of around $6

billion. Putin and Transneft have made the completion of the first stage a top

priority. Construction began five months late in April 2006, and the first

stage is expected to be complete by late 2008. The second stage of the pipeline

will run from Skovorodino to the Pacific

Coast, and it will have a

capacity of 1.6 million bbl/d.

(Source:

US Government, click to enlarge)

The route to Kozmino

Bay is significantly more expensive

than an alternative route to Daqing,

China, since it

covers a greater distance and involves more investment. However, the new route

will open up a new Pacific port from which Russian oil exports could be shipped

by tanker to other Asian markets and possibly even to North

America.

The initial stage of the ESPO pipeline

will get significant volumes of sweet crude from the TNK-BP-led East Siberian

Verkhnechonsk field, in which Rosneft is a partner, and from Surgutneftegas'

Talakan field. Also, significant volumes (up to 270,000 bbl/d

by 2010 according to Degolyer & McNaughton) would come from

Rosnefts Vankor field. Production from the three fields alone should be able

to fill the pipe by around 2011.

Some hurdles exist to the Eastern

Pipelines plan. First, financing the project is challenging. Russia has

obtained Japanese promises of $7 billion for the project, but the first stage

will be financed with a $2.4 billion revolving credit from state-owned

Sberbank. The route passes through multiple environmentally sensitive areas

which could have the potential to further delay the project. Finally, the

government estimates that transportation tariffs could be roughly $6 per

barrel, but other outside analysts estimate the level at up to $10 per barrel,

which would help pay for increasing capital costs.

Oil Shipment: Black

Sea

After Russian oil flows through the

various pipelines described above, crude oil and products are shipped onward to

Europe, the United States,

and Asia via tanker. The bulk of Russia's oil (roughly 1 million bbl/d of crude)

is shipped to the Mediterranean and to Asia via tankers in the Black Sea,

mostly from the port

of Novorossiysk. With the

opening of the BTC pipeline in early 2006 and rising oil production exports

from Caspian countries, Black Sea port shipments through the Bosporus

will likely remain at around the same levels for the next couple years. The new

Russian support for the Bourgas Alexandropoulis pipeline route, combined with

existing support, makes this option one of the more commercially-feasible

routes to help alleviate flows via the Bosporus.

Alternate Oil Export Routes

Rail exports comprise roughly 5% of

Russian crude oil exports. But unless significant investment

flows into expanding the Russian pipeline network's capacity, non-pipeline

transported exports are poised to increase even more in the upcoming years.

As China's growth continues,

rail routes are the only way to provide Russian crude oil to East

Asia. In the absence of a dedicated pipeline route, Russian crude

oil is exported via rail to the northeast cities of Harbin

and Daqing and to central China

via Mongolia.

Rail exports of crude oil to China

increased from approximately 200,000 bbl/d in 2005 to 300,000

bbl/d by 2006 according to Chinas Ministry of Railways.

-Natural Gas-

Russia

has the largest natural gas reserves in the world, but the countrys aging

natural gas infrastructure, and monopolistic industry have created unneeded

inefficiency.

Overview

Russia holds the worlds largest natural gas

reserves, with 1,680 trillion cubic feet (Tcf)--

nearly twice the reserves in the next largest country, Iran. In 2004 Russia was the

worlds largest natural gas producer (22.4 Tcf), as well as the worlds largest

exporter (7.1 Tcf). According to official Russian statistics, production during

2005 and 2006 is predicted to be about the same with around 1 percent growth

rate per year.

Gazprom, Russia's

state-run natural gas monopoly, produces nearly 90 percent of Russias

natural gas, and operates the countrys natural gas pipeline network. Gazprom

is also Russias

largest earner of hard currency, and the companys tax payments account for

around 25 percent of federal tax revenues. Despite its enormous size and

significance, Gazprom is seriously encumbered by domestic regulation. By law,

the company must supply the natural gas used to heat and power Russia's vast

domestic market at government-regulated prices (approximately $28 per thousand

cubic meters), regardless of profitability.

Gazproms natural gas production forecast

calls for modest growth of 1-2 percent per year by 2008. Russias natural

gas production growth has suffered due primarily to aging fields, state

regulation, Gazproms monopolistic control over the industry, and insufficient

export pipelines. Three major fields (called the 'Big Three') in Western

Siberia--Urengoy, Yamburg, and Medvezh'ye comprise more than 70 percent of

Gazprom's total natural gas production, but these fields are now in decline.

Although the company projects increases in its natural gas output between 2008

and 2030, most of Russias

natural gas production growth will come from independent gas companies such as

Novatek, Itera, and Northgaz.

The Mid-term outlook for Gas Supply from Russia

For Gazprom to fulfill its long-term aim

of increasing European sales, it will need to boost its production, as well as

to secure more reliable export routes to the region. According to a 2006

International Energy Agency (IEA) report, Gazproms three largest fields are

declining at an average rate of 700 Bcf per year, necessitating around 6,100

Bcf per year of new production by 2015 to maintain current production levels.

Gazprom began importing natural gas from Turkmenistan

to help fulfill its supply contract with the Netherlands. Since then, Turkmenistan and Russia

have had repeated disputes over the pricing of the natural gas which resulted

in a halt to natural gas supplies to Russia in 2004.

Gazproms management approved an

aggressive investment program in 2005 of around $10.8 billion per year. Much of

the investment has gone into foreign acquisitions and planning for the

Nordstream pipeline. Little, in comparison, has been spent on investing in some

of Gazproms known, yet undeveloped resources in the Yamal peninsula, partly

because of their high cost.

Oil companies, whose natural gas is

largely flared, and independent gas companies will play an important role by

increasing their share of Russian total production from 9 percent in 2005 to

around 17 percent by 2010. Their success, however, depends largely on gaining

access to Gazproms transmission system

Shtokhman

Discovered in 1988 in the Barents Sea, the Shtokhman field contains reserves of an

estimated 19 billion barrels of oil equivalent. The fields location, roughly

340 miles northeast of the Russian mainland and 1000 feet deep, makes its

development particularly challenging. International Oil Companies (IOCs) had

hoped to participate in the fields development, but in Fall

2006, Russia

announced it would develop the field on its own.

Domestic Gas Prices

Domestic gas prices in Russia are only around 15-20 percent of the

market rate at which Russias

gas is sold to Germany,

and Gazprom lost around $420 million in 2006 on domestic natural gas sales. The

government regulates prices only for Gazprom's domestic supplies, which

currently make up 76 percent of the market, while independents are free to set

their own price. Given Gazprom's dominance, the going price of independent gas

is usually higher only by 10 percent to 15 percent.

Low prices have impacted the gas

industrys ability to finance capital spending and have hurt incentives to

increase efficiency. Raising domestic prices towards parity with market rates

in Europe is now a major component of the

countrys energy strategy that will play a significant role in avoiding supply

shortfalls in the future. In November 2006, the Russian government approved a

program to gradually increase gas prices to market levels, with initial

increases of around 15 percent in 2007. Under the program, the Federal Tariff

Service will stop setting caps on Gazprom's prices for industrial consumers in

2011 and for residential consumers in 2013.

Import and Export Markets

Russia exports significant amounts of natural

gas to customers in the Commonwealth of Independent States (CIS). In addition,

Gazprom (through its subsidiary Gazexport) has shifted much of its natural gas

exports to serve the rising demand in countries of the EU, as well as Turkey, Japan, and other Asian countries

(see Table 3).

Rising domestic demand

In 2006, Gazprom, which has a monopoly on

Russian gas exports, transported 5.3 Tcf (roughly 60%) to destinations outside

the CIS and the Baltic states, an increase of

3 percent from 2005. Exports of Russian gas to neighboring Baltic and CIS

countries totaled 1.3 Bcf in 2006 (not including re-exports of Central Asian

gas). The latest data for 2005 estimates that exports to neighboring Baltic and

CIS countries, including re-exports, was approximately

2.7 Bcf.

Ukraine-Russia Natural Gas Dispute of

January 2006

Due to an ongoing dispute about natural

gas prices, on January 1, 2006, Gazprom shut off gas supplies to Ukraine, and as a result supplies to Europe were also affected. Even though Russia has used the threat of a cutoff to demand

higher natural gas prices in recent years, this was the first time that a

supply disruption affected flows to Europe.

After negotiations with Ukraine,

Russias natural gas company

agreed to a sell its natural gas to RosUkrEnergo, a trading company that also

imports natural gas from Central Asia, at the

market price of $6.51/mcf ($230 per thousand cubic meters).

Ukraines January 4, 2006 agreement entails the

purchase of 580 Bcf of natural gas from RosUkrEnergo at $2.69/mcf each year for

five years. Some of the natural gas is comprised of less expensive natural gas

from Central Asia). The contracts are also

subject to review each year and may be adjusted to new market prices. In 2007, Ukraine proposed a return to the barter

agreement where Ukraine

would receive 1.06 Tcf from Russia

in exchange for transiting roughly 4.4 Tcf of Russian natural

gas to Europe.

Major

Proposed Natural Gas Pipelines

Yamal-Europe

II

The Yamal-Europe I pipeline (1 Tcf),

which carries natural gas from Russia

to Poland and Germany via Belarus, would be expanded another

1 Tcf under this proposal. Gazprom and Poland

currently disagree on the exact route of the second branch as it travels

through Poland.

Gazprom is seeking a route via southeastern Poland

to Slovakia and on to

Central Europe, while Poland

wants the branch to travel through its own country and then on to Germany.

Expansion is expected to be complete by 2010 at a cost of around $10 billion.

Blue Stream Expansion and Interconnection

The Blue Stream natural gas pipeline

connects the Russian system to Turkey

through a 750-mile pipeline, 246 miles of which extends underneath the Black Sea (see map). Natural gas began flowing through

the pipeline in December 2002, under an initial schedule of 71 Bcf per year,

which was to increase by 71 Bcf annually. Even though flows through the

pipeline totaled only 113 Bcf during 2004, the recent launch of a new gas

compressor station in Russia

will allow the pipeline to run at its design capacity of 565 Bcf per year.

During 2005, roughly 160 Bcf of natural gas has been transported via Blue

Stream. Gazprom is still discussing plans with its project partner Eni whether

to construct an extension to Ceyhan or Izmir (in

Turkey),

where the gas could be liquefied for export. Another option is to access the

planned 280-350 Bcf Poseidon pipeline, which will bring Caspian and Middle East

gas to Italy via Turkey and Greece starting in 2010.

In March 2003, Turkey halted deliveries through

Blue Stream, invoking a clause in the contract allowing either party to stop

deliveries for six months. After Russia

filed suit in Stockholm's International

Arbitration court, the two sides came to an agreement in November 2003 and the

supply of natural gas to Turkey

resumed in December 2003.

Nordstream Pipeline (or North European

Gas Pipeline)

A northern pipeline extending over 2,000

miles from Russia to Finland and the United Kingdom via the Baltic Sea, was

proposed in June 2003 by Russia and the UK, and was renamed Nordstream by the

stakeholders in 2006. About 700 miles of the pipeline will pass under the Baltic Sea. In November 2006, Gazprom (51% shareholder),

and Germanys BASF and E.ON

(24.5% each) submitted project information to Baltic Sea

countries for the start of an environmental impact assessment. Offshore pipe laying is expected to begin between 2008 and 2010. The

project is expected to cost $5.7 billion and to transport approximately 0.9-1.0

Tcf of natural gas via two strings beginning by 2010. A second pipeline, which

would double the transmission capacity could be built

if demand necessitates it.

The main advantage of this pipeline is Russia will no

longer have to negotiate transit fees with nearly half a dozen countries or pay

them in natural gas. A possible spur connection to Sweden has also been considered.

Polish and Latvian leaders have expressed frustration that they were not

included in the negotiations.

Natural Gas for China

The Kovytka natural gas field, 63 percent

owned by TNK-BP, could provide China

with natural gas in the next decade via a proposed pipeline. The project is

expected to come online in June 2007 after an 80-mile pipeline to Irkutsk is completed that would only provide natural gas

to largely local industrial users in E. Siberia.

China has stated it is ready

to import up to 700 Bcf per year from the project; but since the natural gas

would not arrive until 2012 at the earliest and since China is

pursuing other natural gas import plans in the meantime, it is possible that

Kovytka natural gas will not have a buyer. Also, Gazprom, which has long wanted

a stake in the Kovytka field, does not favor a direct link from the field to China that is

not a part of its natural gas pipeline network. The Russian government is also

threatening to revoke TNK-BPs production license if a deal is not made during

2007 to pave the way for construction of the main export pipeline to China.

-Coal-

Russia

has the second-largest amount of recoverable coal reserves in the world, and

the Russian Energy Ministry is optimistic about future growth. Safety concerns

and adherence to the Kyoto

protocol could hinder the industrys potential.

With 173 billion short tons, Russia holds the world's second largest

recoverable coal reserves, behind only the United States, which holds roughly

274 billion short tons. Between 1996 and 2001, Russia worked with the World Bank

to restructure the country's coal industry. As a result, the state monopoly,

formally known as RosUgol, has been dissolved, and roughly 77 percent of

domestic coal production comes from independent producers. Russian coal

production began a three-year upswing in 1999. After a slight decline earlier

in the decade, production has increased markedly in recent years. Russian

energy ministry sources estimate that total coal production was 269.6 million

short tons in 2005 (roughly a quarter of U.S. coal production) and the fifth

largest in the world.

According to the government's energy

strategy, Russia

should produce between 441 and 496 million short tons by 2020. The government

has high hopes for the future of the coal industry. Exports of coal and coke from

Russia to CIS countries rose by around 50% between 2004 and 2005, and recent

articles in the trade press expect rising coal demand (especially in Asia) to

continue. However, various problems may hinder the industry's development

potential. Russia's

agreement to the Kyoto Protocol may lower utility sector demand for coal.

-Electricity-

Russias

electricity sector is in need of investment and repair. Rising electricity

consumption during 2006 has increased natural gas consumption and has thus

threatened Russias

ability to provide ample supply to its export partners. The government is

looking towards nuclear power as a solution.

Generation

Russia's power sector includes over 440 thermal

and hydropower plants (approximately 77 of which are coal-fired) plus 31

nuclear reactors. A few generators in the far-eastern part of the country are

not connected to the power grid.

The system has a total electric

generation capacity of 205.6 gigawatts (GW), with 2004 output of approximately

881.6 billion kilowatt hours (Bkwh). After the collapse of the Soviet Union, economic recovery contributed to an

increase in total electricity consumption from 715 Bkwh in 1998, to roughly 804

Bkwh in 2004. Thermal power (oil, natural gas, and coal-fired) accounts for

roughly 63 percent of Russia's

electricity generation, followed by hydropower (21%) and nuclear (16%).

Nuclear Power

The Russian government has stated that it

intends to expand the role of nuclear and hydropower generation in the future

to allow for greater export of fossil fuels. Russia

has an installed nuclear capacity of 21.2 million kilowatts, distributed across

31 operational nuclear reactors at 10 locations, all west of the Ural Mountains. However, Russia's nuclear power facilities

are aging. Fifty percent of the country's 31 nuclear reactors use the RBMK

design employed in Ukraine's

ill-fated Chernobyl

plant. The working life of a reactor is considered to be 30 years: nine of Russia's plants

are between 26 and 30 years old, and six are between 21 and 25 years old.

On July 15, 2006, Russian Prime

Minister Mikhail Fradkov approved a $55 billion nuclear energy program that

calls for the completion of ten new 1,000 megawatt (MW) reactors by 2015, with

an additional ten reactors to be in various stages of construction by that

time.

These plans will be challenged both by

rising nuclear fuel costs and by generation from competitive alternative fuels

such as natural gas. Many nuclear plants are also due for decommissioning and

meeting this target will require between $5 and $10 billion per year of

investment over the next decade.

The Russian government has also made

hydroelectric generation a priority, particularly in the country's Far East, where provision and delivery of electricity

supply can be problematic. In June 2003, a representative from the country's

largest generation owner, Unified Energy System of Russia (UES) , told reporters that the company plans to invest $14

billion in the development of Russia's

hydroelectric sector, particularly in Siberia and the Far East.

Transmission and Distribution Sector

There are seven separate regional power

systems in the Russian electricity sector: Northwest, Center, Middle Volga,

North Caucasus, Urals, Siberia, and Far East.

The Far East region is the only one not

connected to an integrated power system. UES, which is 52 percent owned by the

Russian government (Gazprom now has a 10% stake), controls most of the

transmission and distribution in Russia. UES owns 96 percent of the

transmission and distribution system, the central dispatch unit, and the

federal wholesale electricity market (FOREM). The grid comprises almost 2

million miles of power lines, 93,000 miles of which are high-voltage cables

over 220 kilovolts (Kv).

Electricity Exports

Russia exports significant quantities of

electricity to the countries of the former Soviet Union, as well as to China, Poland,

Turkey and Finland. UES

also has plans to export electricity to Iran

and possibly Afghanistan and

Pakistan from two

hydroelectric stations it is currently building in Tajikistan. There are currently two

efforts underway to integrate the Russian and Western European electricity

grids. UES is participating in the Baltrel program, designed to create an

energy ring of power companies in the Baltic states. Also, the Union

for the Coordination of Transmission of Electricity (UCTE), of which 20

European countries are members, has entered into discussions with Russian

colleagues over the technological and operational aspects of interconnecting

their systems.

Privatization and Electricity Market

Reform

As part of the reform begun in March

2004, Russian President Vladimir Putin signed six bills into law that aim to

substantially reform the industry. Under the new laws, tariff rates on the

domestic market are to be made more universal instead of

geographically-specific. In November 2006, Energy Minister Khristenko said that

electricity rates will increase by 10 percent in 2007 and that around 5 percent

of the electricity market will be liberalized beginning January 1, 2007. The

reform also calls for UES's generation and distribution facilities to be

privatized, but the country's transmission grid will remain under state

control. The main goal of the Russian electricity reform package is to create a

generating sector divided into multiple wholesale electricity companies

(commonly called 'OGKs'), which participate in a new competitive

wholesale market.

In September 2006, the Russian cabinet

finally approved the spin-off and privatization of two generating companies

(gencos), Wholesale Generating Company (OGK)-5 and Territorial Generating

Company (TGK)-5, as well as an additional 11 gencos to be spun off during 2007.

The UES reform plan will distribute UES stakes in 20 gencos on a pro-rata basis

to current UES shareholders. The state, with 53 percent ownership, is the

largest shareholder in UES.

The current plan is to transfer the

state share in the gencos to two companies, the Federal Grid Company and the

Hydro-OGK, which will remain state-controlled after UES ceases to exist on July

1, 2008. The goal is for the market to become completely liberalized by 2011.

Gazprom and UES

Gazprom would like to have a key role in

the electricity sector during the deregulation process in order to influence

decision-making on the fuel mix and to benefit from electricity and natural gas

tariff liberalization. As a result, in March 2007, Gazprom and UES signed a

long term, take-or-pay agreement for gas supplies for Russian electricity

generation through 2010 where UES will receive around 3.6 Tcf per year of gas

directly from Gazprom. Independent gas producers will meet the remainder of

UESs fuel needs.

![]()