| CATEGORII DOCUMENTE |

| Bulgara | Ceha slovaca | Croata | Engleza | Estona | Finlandeza | Franceza |

| Germana | Italiana | Letona | Lituaniana | Maghiara | Olandeza | Poloneza |

| Sarba | Slovena | Spaniola | Suedeza | Turca | Ucraineana |

Budget Development and Cost Calculation

Nothing gets done without money. Projects are no exception, and Perry is the first to realize this.

There are many reasons for calculating costs before they are incurred. To begin, they give an idea of how much the goals will cost to achieve. Cost calculations later become a tool for measuring the efficiency of a project team. They also help determine priorities as the project progresses. Finally, they contribute to the overall profitability of a company.

As project manager, Perry has several responsibilities for budgeting. He must develop budgets on a task-by-task basis and for the entire project. He must ensure that expenditures stay within the budget allocated for each task and the project as a whole. He seeks additional funding, if necessary. Finally, he tracks and monitors expenditures, identifying and reporting deviations to upper management.

When estimating his costs, Perry establishes a management reserve, usually 3 to 5 percent of the total estimate for the project, to address unexpected costs. This reserve increases the overall cost estimate for the project.

Later, while controlling his project, Perry uses the cost estimates to compare to actual expenditures. Of particular importance are estimates versus actual costs up to a given point. If the actual costs exceed the estimated costs up to a specific point, an overrun exists. If the actual costs are less than the estimated costs up to a specific point, an underrun exists. Perry looks for overruns and underruns on a task-by-task global basis. If the feedback has an overrun, for example, Perry takes corrective action.

Different Kinds of Costs

Perry knows that many items in a project cost money. The typical ones are:

Equipment (purchase, lease, rental, and usage)

Facilities (office space, warehouses)

Labor (employee, contract)

Supplies (paper, pencils, toner, sundries)

Training (seminars, conferences, symposiums)

Transportation (land, sea, air)

The standard formulas for calculating these costs are:

Equipment = purchase price

or

lease price time period

or

rental price time period

Facilities = lease price time period

or

rental price time period

Labor costs = (regular hours hourly rate) + (overtime hours time and a half rate) + (overtime hours double time rate)

Supplies = quantity unit price

Training costs = (tuition cost number of attendees) + (the sum of the labor costs for attendees)

Transportation costs = (daily, weekly, monthly, or hourly rate) (period of usage)

There are also different ways to classify costs.

Direct vs. Indirect Costs

Direct costs directly relate to the building of a product for example, materials and specialized labor. Indirect costs are other than direct costs and not necessarily related to the building of a product for example, rent and taxes.

Recurring vs. Nonrecurring Costs

Recurring costs appear regularly for example, long-term payments for facilities. Nonrecurring costs appear only once for example, the purchase of equipment.

Fixed vs. Variable Costs

Fixed costs are not alterable owing to changes in work volume for example, cost of facilities usage. Variable costs vary depending upon consumption and workload for example, cost of materials.

|

Activity-Based Costing (ABC) Activity-based costing (ABC) is a process approach to accounting, giving a realistic portrait of the total costs for a project. With traditional accounting methods, labor is seen as the primary contributor to costs, while with ABC, overhead and materials have significant impact. Traditional accounting emphasizes 'hacking away many heads,' not reducing material and overhead costs. ABC instead focuses on processes and their improvement, not just reducing head count. It also focuses on customers, since the true cost of the final product is passed on to the customers. Project managers can play a major role in furthering the use of ABC. ABC also requires good definitions of what the customer wants (statement of work), a list of the activities for meeting those wants (work breakdown structure), and fixed monies (cost estimates) to produce the product or deliver the service. Project managers can realistically determine direct and indirect costs and also determine what processes to improve or remove in order to increase customer satisfaction and reduce costs. |

Burdened vs. Nonburdened Labor Rates

Burdened labor rates include the cost of fringe benefits for example, insurance and floor space and nonlabor overhead. Nonburdened rates are labor rates minus the cost of fringe benefits and overhead.

Regular vs. Overtime Labor Rates

Regular labor rates are less than or equal to 40 hours per week. Overtime labor rates are more than 40 hours per week, including time and a half and overtime.

How to Calculate Costs

Making a reliable cost estimate depends on the amount of information available for estimating. Having more information means you have greater ability to discern the elements that constitute an estimate. Making a reliable cost estimate also depends on a good work breakdown structure (WBS); see Chapter 6. And, of course, to produce a reliable cost estimate requires a good project definition; the better the definition, the more reliable the estimate because the parameters of the final product or service have been established; see Chapter 5.

Obtaining a reliable cost estimate depends on good time estimates, too. Most cost estimates rely on a count of labor hours to complete work. If the work estimate is reliable, then the costs should have an equivalent reliability, since they represent hourly rate times total hours; see Chapter 7. Finally, estimates often are based on assumptions. Unless identified, these assumptions can lead to misunderstandings and ultimately to inaccurate calculations. The assumptions are spelled out in the statement of work; see Chapter 5.

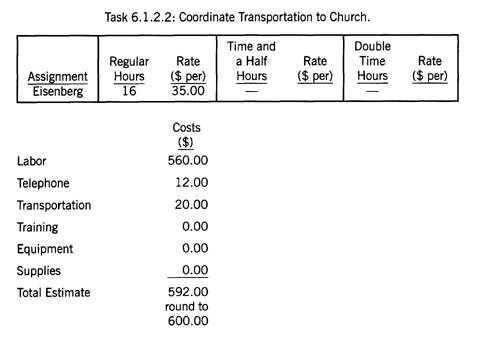

What follows is an example of how Perry estimates the costs for each task in the WBS. He uses a worksheet format (Exhibit 11-1) to calculate the figures. The summary of his calculations is the total cost for the project, excluding the management reserve.

Perry tracks the estimate-at-completion for each task and the management-estimate-at-completion (MEAC). The estimate-at-completion is a combination of actual expenditures to date up to a specific point plus the remaining estimate to complete the project. The MEAC is the actual expenditures to date plus the remaining estimate to complete the entire project. Both the estimate-at-completion and the actual expenditures to date give

Exhibit 11-1

Worksheet for estimating costs.

|

Costs |

|

|

Labor | |

|

Telephone | |

|

Transportation | |

|

Training | |

|

Equipment | |

|

Supplies | |

|

Total Estimate |

592.00 |

Perry a good idea of how well expenditures have gone and will go if the current levels of performance continue.

What Happens If Cost Estimates Are Too High?

Frequently, project managers are asked to reduce their estimates. Top management often feels that a project can be completed with less money. It may even declare a 10 percent across-the-board reduction for all projects. Dealing with such commands is one of the hardest challenges facing project managers. Fortunately, they have several options.

The project manager can communicate her reasons for the cost estimates. She can explain, for example, the rationale behind the time estimates and the accompanying calculations. Presenting the reasons and assumptions especially gives a persuasive argument for retaining the cost estimates.

The project manager can also develop revised cost estimates. Based on feedback from senior management, she can select the best revised estimate.

Finally, the project manager can negotiate with the customer to reduce or revise the scope of the project, reduce the work requirements as described in the work breakdown structure, reduce the time estimates, and modify the assignments. Ultimately, revisions to the scope will then be reflected in the estimated costs.

The key: Identifying and Managing Costs

Money is the oil that gets projects moving and keeps them running. The Smythe Project is no exception. Perry appreciates the importance of identifying and managing costs throughout the life of the project. He knows that how he categorizes costs is not as important as ensuring that the project completes within budget.

Perry knows, too, that costs, along with schedules, are susceptible to positive and negative changes that may increase or decrease the reliability of his estimates. To a large extent, this reliability will be affected by the degree of risk associated with his schedule and cost estimates.

Questions for Getting Started

Did you identify all the types of costs for your project?

Did you identify the rates for usage and quantity that you plan to consume?

Did you calculate the total costs by summing the totals for each task?

If you elect to have a management reserve, did you determine the appropriate percent to be multiplied against the total costs of the tasks?

If you received pressure from your management or the customer for having too high an estimate, did you develop alternative ways to deal with their resistance?

|

Politica de confidentialitate | Termeni si conditii de utilizare |

Vizualizari: 1296

Importanta: ![]()

Termeni si conditii de utilizare | Contact

© SCRIGROUP 2026 . All rights reserved